Pricing Curves: a New Model for Restaurant Memberships and Fandom?

Wherein we consider how restaurants and guests could both benefit by following Friend.tech's lead

This post comes to you courtesy of Jake Schlessinger, a product manager here at Blackbird Labs, Inc. Jake will be using the space below to discuss pricing curves and what they could mean for the hospitality memberships of the future.

Today, I want to talk about pricing curves, or—as they’re more commonly referred to in the world of web3—Bonding Curves. I’m particularly interested in how their implementation could be beneficial to the platform we’re building here at Blackbird, especially when we think about restaurant memberships. I love a good market structure deep dive, so let’s get into it.

First we need to define Bonding Curves. As per Outlier Ventures, “Bonding Curves are essentially a way of ossifying the relationship between price and supply. An even simpler way of saying this is: as the supply of tokens changes by X, the price changes by Y – where Y can be either a fixed value or a percentage.”

In other words, more tokens = higher price per token. Now this might go against your grasp of supply and demand. Typically, scarcity—not an abundance—drives up price, especially in secondary markets (we’ll get there). Under a Bonding Curve, it’s the opposite. Yes, the market dictates the price, but it behooves early adopters. Buy early and be rewarded with a cheaper price; buy later when there are more tokens and you’ll pay more.

Without going too deep into the crypto trenches, let’s consider how a Bonding Curve functions in the real world. A perfect case in point is Friend.tech, a tokenized social network that has quickly become the hottest topic in crypto and could scale beyond that hardcore crowd. The premise is simple: invest in people, their expertise, and their networks. By taking advantage of a mobile first experience with a simple premise, Friend.tech allows users to buy and sell access to private creator channels, spanning everything from direct chats with someone like, say, Grayson Allen of the Milwaukee Bucks, to getting strategies on stocks and crypto from @The_Bogfather. With over $6m (source: Defillama) in revenue since its inception in August, Friend.tech proves that people are very excited by the idea of trading their friends and favorite creators, all powered by a Bonding Curve. The ecosystem is working, too — top creators on the platform are commanding nearly $10,000 to gain access to their chat (0xRacerAlt on X). Users can benefit too by later selling their tokens—both immediately and directly— at the new market-determined price.

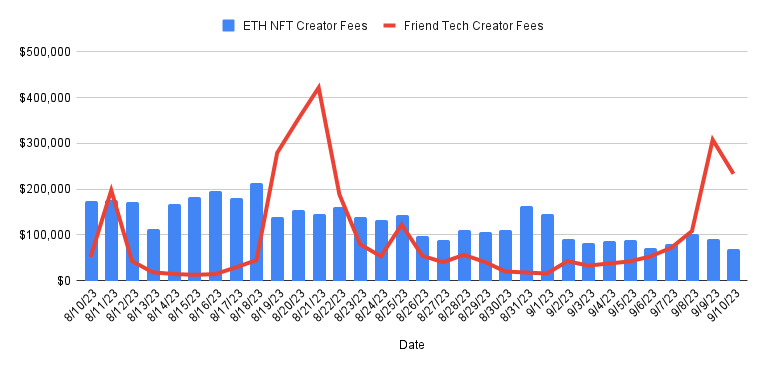

From a financial perspective, however, the Friend.tech model is one that truly benefits creators. Consider the following 🤯 stat: “In the past two days, @friendtech trades have paid creators $500,000, more than 3x as much as the entire ETH NFT ecosystem has paid creators.”

Incentivizing Restaurant Fandom

The stat above is particularly interesting to Blackbird. We think of our restaurant partners as creators, and—being the fans that we are—we want them to run financially viable businesses in an industry that has proven extremely hard to turn a profit in. A Bonding Curve could help change that, especially in regards to memberships. Not only will restaurants not have to figure out their pricing, deferring instead to the market, but the demand is already there. Take for instance last spring, when Brooklyn restaurant gertrude’s offered founding memberships as a way to bridge the final gap in their fundraising efforts, guests flocked at the opportunity…all to the tune of an additional $60k in capital raised. This proves that guests want to get involved! By using a Bonding Curve model, Blackbird restaurants could sell memberships at a lower initial price, thus incentivizing and benefiting early members — aka, the restaurant’s most loyal fans.

Fans is the operative word here. These days, dining is entertainment, and restaurants are part and parcel of that pop culture. Guests feel strongly about the restaurants they love, even (or, in many cases, particularly) those unsung holes in the wall that have yet to catch on with the general public. Like loving that indie band that no one else has heard of yet, or the underdog sports team we root for, we want to champion these restaurants. A Bonding Curve pricing model allows early members to do so. Over time, the restaurant can generate more revenue as more premium memberships are sold. Users, on the other hand, could immediately/seamlessly buy or sell their memberships to specific spots as prices continue to trend upward. Since royalties would be baked into the contract, a la NFTs, restaurants would still get a percentage of resales, thus generating recurring revenue — win-win.

It’s interesting to think of the use cases above, and how a methodology already seeing such success on Friend.tech could be applied to the IRL world of restaurants and hospitality in general. What do you think…should a Bonding Curve be put in our product roadmap? We’d love to hear from you — let us know your thoughts in the comments below!

Jake Schlessinger

Product Manager

Blackbird Labs, Inc.

Introducing a pricing curve for memberships would bring on lots of second order effects. When money is involved people will inevitably try to game the system. As we see with friend.tech, there will be bots that will instantly snap up keys once they come online. Additionally, allowing speculation will inevitably lead to bubbles where people will lose money and get a bad taste from the experience (see most NFT projects).

Gertrude's selling 60k in memberships with no ability or promise to resell is a nice proof of concept for customer demand. People love their local restaurants and value status when they go there. How to best reward and incentivize these people is an interesting question.

Really interesting thought piece. From the user perspective you can incentivize early adopters, provide a way for loyal users to invest in the growing success of a restaurant, and get insider benefits, but from a restaurant perspective, there's a fair amount of risk to consider.

Restaurants are already riding on thin-margins, the additional overhead of understanding these curves and managing the downside risk of speculation and dumps could be over the heads of most dining entities. When things are going well, they go well until they don't. Perhaps this is a new role in this crazy world (digital revenue mgmt).

Maybe approaching it from the restaurant's north star could inform the outcome better. Does this technology fundamentally allow restaurants to better serve their patrons and fans? Just like how you guys kicked off with Gertrude, we can only know better with experimentation.